no. 8 — Restaurants and democracy

pay-to-play reservations, the restaurant loyalty wars (Blackbird vs DoorDash), and a round of applause for the NYT design team

ICYMI the Times recently put out a fun interactive feature, How to Win the Restaurant Reservation Game, so it felt like high time to address two topics I’ve been meaning to write about.

First, a moment for New York Times’ graphic design team

Ok this restaurant feature was another reminder that the Times’ visual storytelling is in a league of its own, and not enough people are talking about it.

Amidst a legacy media landscape that’s rapidly ceding readership to independent creators, this is one of the ways the Times has continued to reinvent itself and actually grow its digital audience. (It’s also interesting the WSJ, with a new and decidedly bold editor-in-chief at the helm, is now hiring a new Director of Visual Storytelling.)

Anyway! Sharing a shortlist of my favorite NYT interactives for your enjoyment:

How Cooking Videos Took Over the World / The Virtues of Being Bad / How a Vast Demographic Shift Will Reshape the World / Elon Musk’s Unmatched Power in the Stars / How The Legend of Zelda Changed the Game / What It’s Like to Ski Nearly Blind / NYC-specific: An Extremely Detailed Guide to an Extremely Detailed Map of New York City Neighborhoods / The 100 Best Restaurants in NYC (2023) / Where to Eat in New York City This Summer

Now back to restaurants and democracy

Dining has returned to pre-pandemic levels, which means NYC reservation culture is officially out of control again. The Times piece attempts to demystify the booking process with a data-packed case study around Semma, one of 16 restaurants the Infatuation included on its list of toughest reservations in NYC.

As it played out, nearly every Semma time slot was reserved and another ~800 names were on the Resy waitlist, but the Times team still managed to snag a table for two via walk-in. Its pro tips weren’t particularly illuminating (be patient, be flexible, react to alerts quickly, or follow-up at strategic times), but they work.

For diners who put an outsized premium on convenience and certainty, though, a wave of “pay-to-play” tech has popped up, inciting debate around what’s “fair” and around the role of restaurants in public society broadly.

These tech solutions generally fall into two buckets: (1) marketplaces that dynamically price reservations and (2) membership subscriptions that provide preferred access.

Appointment Trader and Cita each take a 20-30% cut for letting people trade reservations (a 9pm two-top at 4 Charles this Friday would cost me $260 on top of my dining bill). Tablz syncs 3D maps of restaurants to reservation systems so guests can upgrade to certain preferred tables. Think: basic economy to main cabin upsell. (Don’t forget Resy also launched with an uber-style model in 2014, but pivoted for a reason. “It was polarizing and kind of small potatoes.”)

Membership models = paying for access. ResX offers free swapping for last-minute (<24 hours) tables but keeps more popular restaurants behind a $9.99/month paywall. Dorsia is a “free” members-only platform, but it dynamically sets a prepayment amount required to lock in reservations. And then there’s Taste Club, which launched with much fanfare in May as “a national dining & global luxury travel club.” For a cool $7,500 initiation fee plus a $300 / month subscription, members get access to bespoke travel and dining experiences.

This one struck a nerve with Ruth Reichl last summer, when she wrote a self-proclaimed “rant” lamenting the loss of restaurants as once democratic institutions:

I love restaurants. I always have. And I hate that “services” like Taste Club are introducing “exclusivity” “access” and “privacy” to places that once belonged to us all. I know it’s just another sign of the one percent world we now live in, but I find it appalling that what were public institutions are turning into private clubs. It makes me incredibly sad that so many of my favorite restaurants are signing on, setting up barriers, telling us that we might not be the right people to walk through their doors.

I’m in the Ruth Reichl camp that these models penalize the average diner and adulterate restaurant culture at large, but I also just think they’re bad for business.

What’s better for customers and better for restaurants? A fundamental data gap.

Reservation resale marketplaces fuel bot traffic that interferes with real guest bookings, heighten credit card fraud, and are the primary reason restaurants have resorted to introducing reservation fees and prepaid deposits.

When it comes to memberships, companies (in the hospitality industry and beyond) too often conflate paid subscribers with loyal customers. Having customers who pay for access is completely different than rewarding customers for active engagement. And importantly, opening up premium paid channels often occurs at the expense of other potentially more loyal, engaged customers.

The harsh reality is that restaurants are operating at 3-5% margins, and as few as six no-shows can make or break profitability. That means accommodating premium platforms (including Amex Global Dining Access by Resy) can seem like a compelling way to at least self-select for higher-spend guests. But that’s because it’s one of the only ways a restaurant today can make an educated guess on a “high value” customer.

For businesses that are in the business of building relationships, restaurants have shockingly little data on their own customers. I won’t cover the analytics provided by reservation management systems (Resy, OpenTable, SevenRooms, etc.) and delivery providers (DoorDash, Grubhub), but suffice to say it’s often de-identified, fragmented, and under a limited lookback period.

And apart from the data sharing issue, there’s also a fundamental gap in data capture: dining data is captured at the reservation / table-level rather than customer-level. So if I went to a restaurant daily for a year but always had a friend make our reservation, that restaurant wouldn’t know I existed (without manually acknowledging and adding my guest profile to a table each time). This also means menu preferences and “regular” flags generally get tagged to the reservation creator rather than accompanying guests. Stating the obvious, if restaurants knew individual diner-level behavior and preferences, they could better identify their most loyal, high value (and high potential value) customers and deliver them much more personalized experiences.

The start of the restaurant loyalty wars

Loyalty is not a new concept in the consumer world. The average consumer who participates in a loyalty program already belongs to 13 others. And Gartner predicts that one out of three businesses that don’t have a loyalty program in place will launch one by 2027.

But loyalty offerings are also evolving as they expand. Traditional punch card and cash back programs are being replaced by more bespoke perks (e.g., early access perks, free gifts, concierge service lines). They’re also becoming more platform- rather than brand-focused. Walmart Plus now offers members Paramount Global streaming (to compete with Amazon Prime), Expedia just launched the One Key program (so members can earn and redeem rewards across Expedia, Hotels.com and Vrbo), and Ennismore developed a Dis-loyalty program that kills all points and tiers and encourages members to try new hotels.

Within the restaurant industry, loyalty programs have always been associated with quick service restaurants (QSR) like Starbucks, Dunkin’ 🧡, and even Sweetgreen. But they may finally be extending to full-service dining in a meaningful way.

I referenced the web3 restaurant loyalty platform Blackbird Labs a couple months ago, but it has since raised a $24 million series A (after an $11 million seed round last year) and also conveys a more “democratic” approach than it did at the start.

While Blackbird’s first partners (e.g., Gertrude’s) only listed “pay for access” type memberships, ranging from a $250 “fam” membership to a $4,750 “Pearl” membership, it has since signed on several restaurants that list completely free memberships and offer $FLY awards and other perks at every visit (surprise snacks, rose, an SMS concierge). This feels more intuitive and better aligns with the “becoming a regular” rather than “paying for regular status” ethos. Most importantly, Blackbird is connecting restaurants with their guests directly, and on an individual diner basis.

But as much as I appreciate the direct connectivity and new paths for rewarding loyal customer behavior, the LTV side of the equation here admittedly has key limitations. A loyalty program at Falansai (or any full-service / non-QSR restaurant in a major metropolitan city) simply has a very different ceiling than Starbucks Rewards or Sephora’s Beauty Insider program. I objectively eat out too much, but I still max out at 5-8 visits per year for a favorite local restaurant and 2-3 for one that’s outside of my home or office neighborhood.

Blackbird has already signaled that (1) customers may eventually be able to use their $FLY rewards at other restaurants “or businesses” that use Blackbird (I smell expansion), and (2) customers can opt-in to share their data across restaurants in exchange for 3x rewards. On the surface, this is democratizing access to data across the platform and driving essential marketplace liquidity (better for customers and restaurants). But it also offsets some of the LTV limitations I mentioned. And it makes diners loyal to the Blackbird platform first and foremost, which is smart.

What about DoorDash?

Imo the most immediate upside to LTV for full-service restaurants comes from newer channels: e-comm, cross-selling across restaurant groups, pop-up events (as I’ve written about before), and delivery.

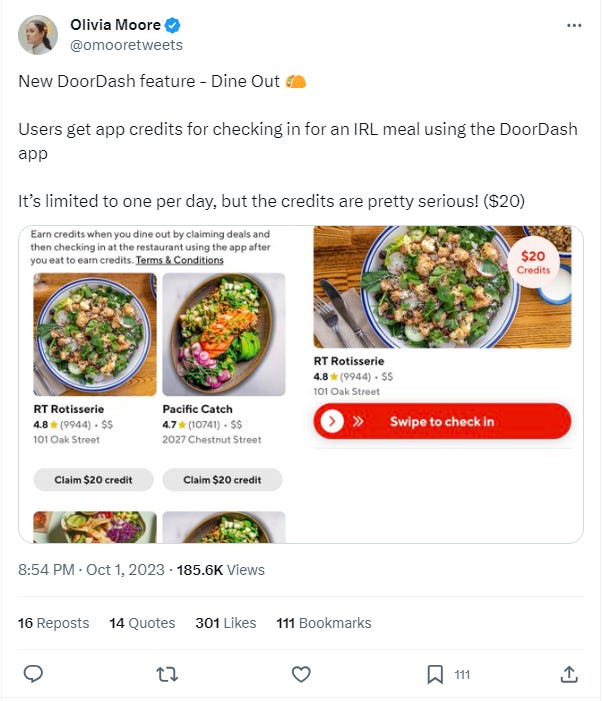

That’s why I read DoorDash’s introduction of a new loyalty program in June and their beta testing of a “Dine Out” rewards feature last month as interesting efforts to bring delivery customers onsite and ultimately own the omnichannel restaurant experience. But that also means DoorDash keeps customer data de-identified so restaurants can't engage with their most loyal customers directly.

The question is whether restaurants will lean into existing tech and a potentially higher aggregate LTV delivered by DoorDash near-term, or care more about owning the direct relationship with their best customers so they can independently figure out ways to maximize LTV over time…

So while Eater might have called Resy the winner of the reservation wars, I think the loyalty wars are just beginning.

DoorDash has a structural head start and is wise to consider expanding from at-home to in-restaurant, but I think Blackbird ultimately wins this war. It's finally telling restaurants what they should have known all along -- who their customers are.